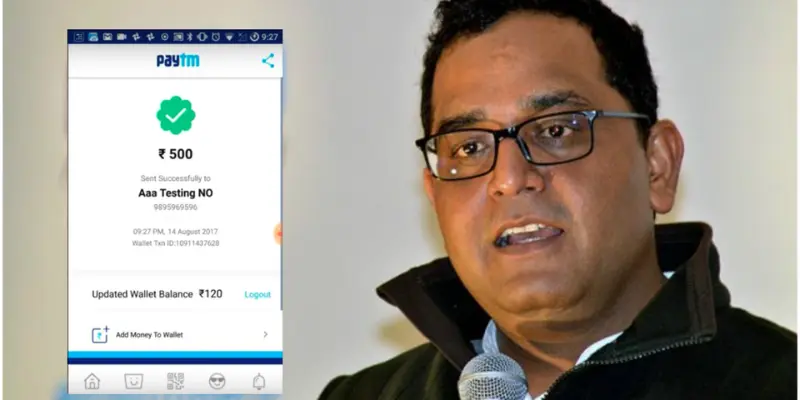

Spoof Paytm App: Credit card validation is now an indelible part of our lives, and with apps like Paytm facilitating quick and impulsive transactions, scammers have found ways to exploit this system. One such trick is the spoofing of the spoof paytm app to generate fake payment confirmations to con the public. Many shopkeepers and businesses have fallen prey to this scam, entertaining themselves with the false idea that some payments came through when in fact no payment was made.

The fraudulent app looks like an identical counterfeit of the genuine spoof paytm app, making it impossible to differentiate between the two. So don’t worry! Here in this article, we will help you understand the wiles of the fake spoof paytm app, the risks involved, and how to safeguard oneself from this trap. Keep informed, keep safe!

What is a Spoof Paytm App?

The spoof Paytm app is simply a replica of the actual Paytm app with a significant difference it cannot transfer money. The app simulates fake payment receipts and transaction messages to fool its victim into thinking that he or she has been credited with money.

Such applications are generally used to cheat shopkeepers or online sellers. They can even be used against one’s close friends or family members. The fraudster will display the fake payment confirmation, and the duped victim thinks that, as per his or her understanding, the money was transferred. In reality, it never even exists.

Usually used for reverse causes, and so becomes the cause of much damage financially if not handled cautiously. So, here, this becomes the most important step to learning when it comes to identifying and avoiding them. So continue reading so you could know how these fake apps work and keep yourself from being scammed!

You May Also Visit This Link

Social Media Painting A New Era of Artistic Expression

Social Media Liker Secrets More Likes More Success

Social Media Gig Image Secrets to Get More Clients

Social Media Fashion Models | UcaTruco

How Do Spoof Paytm Apps Work?

Spoof Paytm apps con people that they have received the payment when there is no transfer of money. These apps look exactly like the original Paytm app, making it very difficult to dog them out. Here is how scammers are fooled by using these applications:

1. Enter Wrong Payment Details

Firstly, the fake payment application is opened and the mobile number, the amount to be “paid,” and a fake transaction ID are filled in.

2. Fake Receipt Generation

As soon as one press the bill location in the app, it creates an impressive confirmation of payment screen, like the official page of successful payment from Paytm.

3. They Show You the Phoney Payment

To make his claim convincing, he will show open screens or send screenshots of ‘his successful transaction to you. Looking exactly as real Paytm receipts, many end up believing it without further inquiry.

4. He Vanishes before you Realize that the Trick Was Pulled

Arguably thinking that the payment had succeeded, you may hand over goods or services. You will, however, know upon checking your Paytm balance later that money had not changed hands! By then, the scammer would have vanished.

These are apps that fraudsters will use to cheat people, either in an offline shop or in a restaurant or even during an online transaction. So verify every payment with a notification from Paytm itself or your bank statement before handing over goods or services.

Potential Risks and Dangers

Spoofing does harm with regard to using apps like Paytm; it causes trouble to the lives of shopkeepers, online sellers, and even common people. Here is what to watch out for:

1. Financial Losses

Most importantly, losses when there is a promise through fake payment confirmation or delivery of products or services without receiving any payment,

2. Commercial Scams

Many small businesses and street vendors have reported losing money due to fake Paytm receipts. In fact, during peak hours, a busy shop will not have enough employees to double-check with the owner or manager.

3. Legal Trouble

Spoofing someone using a Paytm app is against the law and can land one in serious trouble with fines and even imprisonment. Taking or sharing these apps is also a problem.

4. Data Theft and Hacking

Using a fake Paytm app can lead to stealing personal information like your phone number, passwords, bank details, and all that stuff. Stealing an identity and committing much larger financial fraud is possible

5. Loss of Faith

When a business gets duped, it can break consumer faith; customers may feel hesitant to use Paytm due to the fear of getting duped in a transaction.

How to Identify Fake Paytm Apps

Discerning between the genuine and the spoof app is more difficult, as these scams mirror the real application exactly. But here it comes: Some Straightforward Steps to Identify Fake Paytm Apps and Protect Yourself from Fraud.

1. Check Source of App

- Only downloads from official sources such as Google Play Store or Apple App Store should be used for Paytm.

- Avoid unknown websites and links sometimes shared from WhatsApp, Telegram, and other social media.

2. App Icon and Name

- Fake apps usually employ a slightly modified logo or name for theirs.

- Any spelling errors in the app name (such as “Patym,” “Paytmm”) give it away as a fake!

3. Verify Transaction Using Paytm App or SMS

- Paytm sends you an SMS notification for any real transaction on Paytm, as would the bank concerned.

- Now check whether the payment hit your Paytm balance or transaction history; if not, then it is a sure fake.

4. Check for Unrealistic Features

Some spoof apps let the user define any amount and issue themselves an acceptance receipt.

If you notice an app that claims to “hack” or “manipulate” to Paytm payments, that’s a scam!

5. Test with Small Amount

If you are confused, ask the sender to make a tiny payment first (1 or 5 rupees) and check if it shows up in your Paytm account before accepting the remaining payments.

The foundation of a scam is the use of trust and speed to dupe people. Always, remember to pause whatever you are doing to verify the transaction responsibly before handing over the products or services. If you come across a fake Paytm app, make sure to report it right away so that others may be protected!

Protecting Yourself from Spoof Paytm Scams

Scammers are now becoming smarter, but you can always be one step ahead by following these simple tips to protect yourself from spoof Paytm app scams.

1. Verify Payments Always

- Never trust only the screenshot or a payment success screen, they may be fakes!

- Always check your Paytm balance or transaction history before handing over goods or services.

- Check for an official SMS confirmation sent by Paytm or your bank.

2. Accept Payments via QR Code from Paytm

- Let customers easily pay through your official Paytm QR code instead of typing your number.

- This means payments are secure and go straight to your Paytm account.

3. Beware of Unusual Payment Requests

- If someone insists that they have paid but you don’t see the amount in your account, don’t trust them.

- Ask them for their Paytm transaction history in case their so-called proof is but a screenshot.

4. Always be aware and try to educate others

- Ensure that you and your employees are very much aware of the latest schemes and how each works.

- Spread the word among friends, family, and others so that they do not fall prey to such scams.

5. Report Fake Applications and Scammers

- If you happen to see a spoof Paytm app, immediately report it both to Paytm and cybercrime authorities.

- Blocking and reporting suspicious numbers on Paytm is also an option.

Such swindlers rely on the premise that individuals are busy or trusting enough to not check payments really well. Just take that few extra seconds to verify the transactions and prevent fraud.

Paytm Measures Against Spoofing

Paytm as a company is well aware of different forms of spoofing and has taken strong measures to secure users’ interests from fraud. This is how Paytm keeps your transactions safe:

1. Instant Payment Alerts

- Every successful payment through Paytm is followed by an SMS and an in-app notification to the recipient.

- If you haven’t got a notification then it is not a payment, check it twice.

2. Secure QR Code Payments

- Paytm-provided QR code platform ensures that the money goes into the right account.

- There are no fakes for a QR based transaction. Therefore, it’s a safe port for payments.

3. Official Transaction History

- In a real-time manner, the revenue in the Paytm app gets refreshed in seconds.

- An amount doesn’t show in your Paytm balance, so don’t fall for fake screenshots-your payment never happened.

4. Reporting and Blocking Fake Users

- Whenever you believe you are being scammed, simply hit report and block the user from the Paytm app.

- Paytm also periodically checks and deletes fake or suspicious profiles.

5. Awareness Campaigns

- Paytm keeps updating its users about frauds through social media platforms, emails, and notifications.

- It creates awareness by warning people against spoof apps and tips concerning safety.

Always exercise caution despite enhanced security measures from Paytm. Verify all payments and transactions and don’t rely on a screenshot alone. Should you ever find a duplicate Paytm app, report it so that fraud can be curtailed.

You May Also Visit This Link

Hauser Tech 5 Refill | Precision Comfort and Elegance

Despacito Free Fire Magic Music Meets Gaming Fun

Brisk Tech Revolutionizing the Future of Technology Today

Webcom Tech Empowering Businesses with Innovation

Advantages and Disadvantages of Spoof Paytm Apps

While spoof Paytm apps are illegal and unethical, some people still use them to deceive others. Let’s take a look at the advantages (for scammers) and disadvantages (for victims and users in general) to understand their impact.

| Pros |

| Fake Payment Confirmations: Scammers can create fake payment receipts to convince businesses and individuals to believe they have received money. |

| Easy to Use: Countless spoof apps are being developed to look very similar to the real Paytm app, thus, allowing crockery fit with usage. |

| Quickly Executed: Fraudsters can trick dozens of people in a matter of minutes by faking a payment success screen. |

| Cons |

| Loss of Money: Businesses and individuals can part with money by delivering goods or services to somebody who does not deserve them. |

| Legal Ramifications: Using a spoof Paytm app is an offense and can attract penalties or imprisonment. |

| Business Credibility Damage: A business being scammed so often may become scared to accept Paytm payments, thus, hurting its trustworthy customers. |

| Data Theft & Hacking Threats: Some spoof apps may take all such personal data like the phone number, bank details, etc. |

| More Cyber Crimes: Propagation of such fraud apps leads to other digital scams compromising all people’s safety during online transactions. |

Especially if you are the ones getting cheated, there are no benefits to using a spoof Paytm app. Always verify a transaction, whether you are a customer, business owner, or seller. Report any instance of suspected spoof apps you come across to Paytm and the cybercrime authorities.

Common FAQs About Spoof Paytm Apps

Here are some frequently asked questions about spoof Paytm apps, explained in a simple and easy-to-understand way.

1. Defining spoof Paytm app?

Spoof Paytm app is a fake application that imitates the original Paytm application to confuse a user by faking a payment confirmation. Scammers regularly use it to show a hunky-dory paid-up status while no money has traversed.

2. How do scamsters use spoof Paytm apps?

Scammers abuse this app for:

Producing false receipts displaying as payment by the seller or shopkeeper.

Displaying fraudulent success screens claiming he or she has made a payment.

Stealing people’s identities, thereby convincing them that they got paid while they received nothing.

3. How can I check if a Paytm payment is real?

To confirm a real Paytm payment:

Check your Paytm balance or transaction history-if the amount isn’t there, the payment is fake.

Look for an SMS confirmation from Paytm or your bank.

Avoid trusting screenshots-they can be edited easily!

4. How do I identify a spoof Paytm app?

Some signs of a fake Paytm app include:

Different spelling and icon names for the ‘Paytm’ application.

Allowing users to enter their payment amount manually.

Missing UPI payments and transactions.

Asking for unnecessary privileges from the user, like contacts and messages.

5. Can I be duped by someone using a spoof Paytm app?

Yes! Thousands of businesses and people lose money every day due to these false apps. The fraud can take for purchase and then say it paid when no cash has traveled.

6. Is using a spoof Paytm app illegal?

Yes! It is a crime to use or market the spoofed Paytm app. Cyber fraud laws may charge anyone with fines, imprisonment, or both for such actions.

7. What should I do if I find a spoof Paytm app?

So, if you identify a fake Paytm app:

Report it immediately to Paytm and cybercrime authorities.

Spread the word, ie, warn friends, family or businesses.

Download unverified apps from unknown sources.

8. How can I protect myself from Paytm spoofing scams?

Safety Against Paytm Spoof Ensure your Paytm account is checked first before any trust attached to a payment. Payments can be made only through QR code scanning. Just one screenshot, and do not trust it all. Verify payment always. Know your latest online fraud.

Conclusion

Fake Paytm applications are instruments put in the hands of fraudsters for trapping people into fake transactions. Always verify transactions before giving money or goods, whether you are an individual or a businessman, regardless of whether you are an individual or a businessman. Don’t trust screenshots as proof of payments always check your Paytm account for actual payments and use safe QR codes for transactions.

If you learn about any fake Paytm app, file a report with Paytm and the cybercrime authorities without delay. There are many ways to protect oneself and others from online fraud if they remain alert and become acquainted with it. Stay smart, stay safe dont let the scammer win.

You May Also Visit This Link

Spoof Paytm App The Shocking Truth You Must Know

Ullu App Promo Code | Detail Guide | UcaTruco

Undress Ai Tool App Download APK | UcaTruco